myXEMPUS makes preventive care easy for you!

With just a few clicks, you can calculate pension plans yourself, get an overview of the pension gap and view the current status of your pension provision.

Always transparent, always fast, no paperwork.

myXEMPUS simply explained

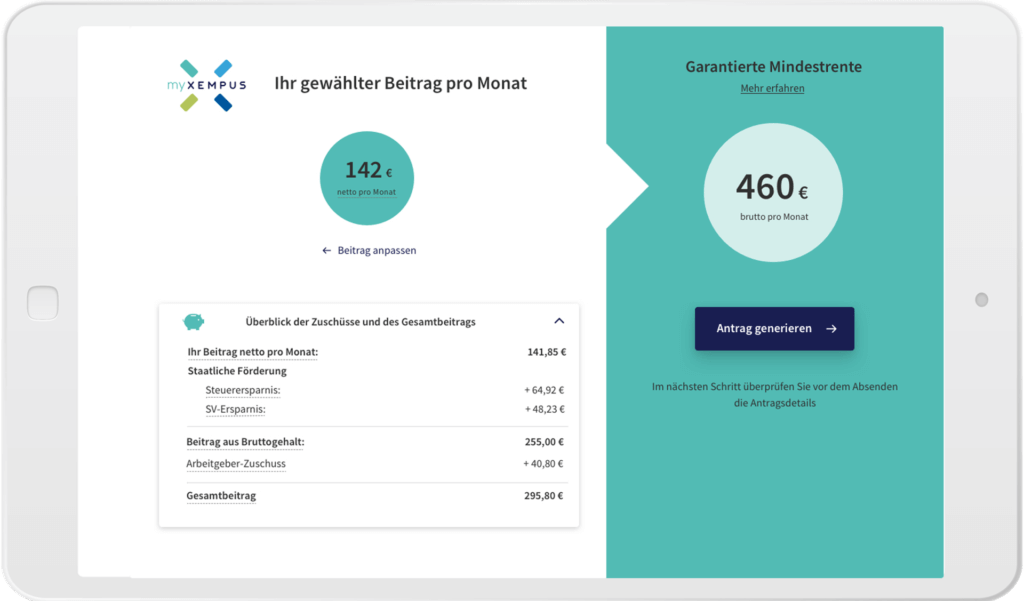

Set your contribution independently.

In myXEMPUS, you can quickly and clearly find out how your own contribution, the state subsidy and the employer’s allowance can be combined to create your guaranteed minimum pension in old age. With just a few mouse clicks you can get to the finished application.

This is the situation with your pension.

Pension gap? Company pension? Guaranteed capital benefit? Everybody loses the overview! Not myXEMPUS. Here you have all figures and projections clearly arranged and up-to-date at a glance.

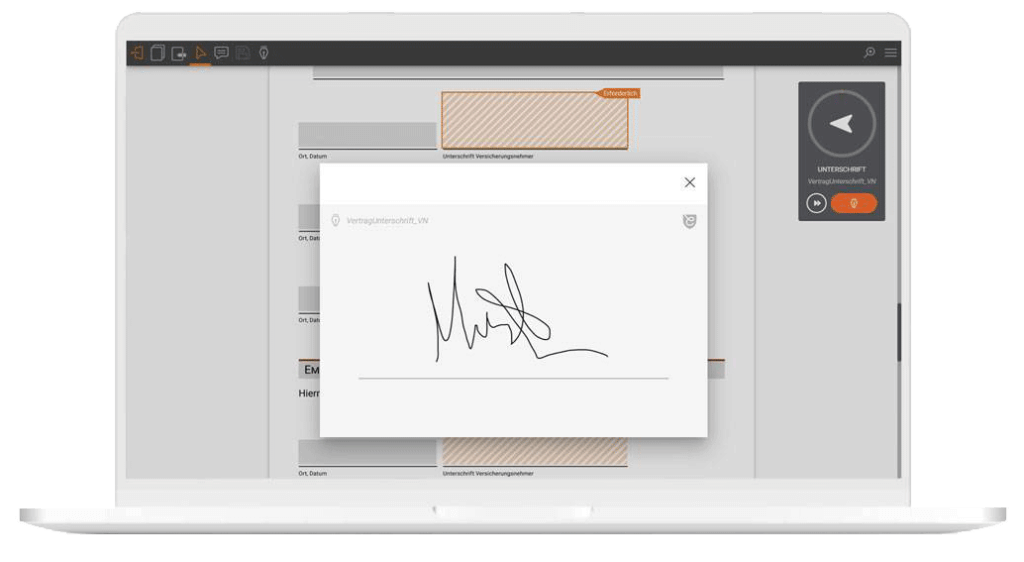

Paperwork adé thanks to digital documents.

File folders are not particularly pretty, heavy and only rarely clear. And then there’s the wasted paper! In myXEMPUS you have all your contracts and documents online and clearly at a glance. Searching through piles of paper has finally come to an end.