Xempus goes live with digital bAV for employers. And offers its own employees the best possible digital provision in Germany.

Munich, December 2, 2021 – Effective immediately, employers can set up their own bAV via the Xempus platform. The Munich-based InsurTech thus offers employers a fully digital bAV for the first time. For companies and their employees, company pension schemes (bAV) are becoming simple all round.

From the employer’s point of view, the new approach has three major advantages: they comply with legal obligations, score points with their employees with occupational pension plans, and introduce them digitally and easily. The target group is small and medium-sized enterprises where occupational pension penetration is low.

Companies receive fully digital bAV for the first time

With the “Xempus manager” employers now get

- easy access to the occupational pension system

- with employee portal “myXempus”, through which employees select their offer online

- compliant with data protection and the law

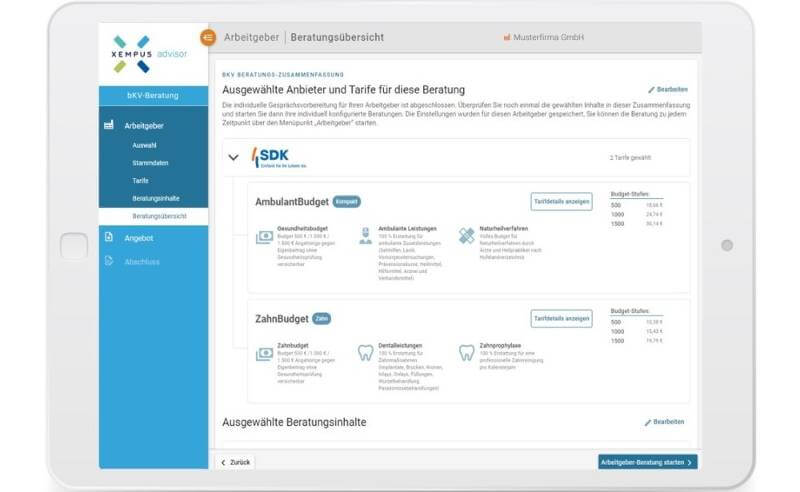

On the Xempus platform, the company itself selects a suitable bAV offer from the options “Savings package”, “Top provision” and “Individual package”. These differ in the percentage of deferred compensation and the tax savings. If you would like personal advice during the course of the transaction, you can call on it at any time. Technical questions are answered by the Xempus service.

“With ‘Xempus manager’, we are digitally addressing a target group that has not been reached before. Employers now have the choice of introducing analog or fully digital bAV,” explains Xempus CEO Tobias Wann.

The technology provider itself is playing a pioneering role in digital occupational pension provision and currently offers its own team the best possible digital provision: in addition to 100 euros a month as an employer contribution, InsurTech gives 100 percent on top for every euro that flows in from deferred compensation. “Every employer commitment counts,” as Wann emphasizes: “If we look at the current pension situation in Germany, every employer who supports his workforce with a company pension scheme is a gain. Our goal is to break down old barriers. The new ‘Xempus manager’ impresses with its ease of use, clarity and transparency.”

Xempus is being launched together with the consulting firm Pension Benefits AG, a subsidiary of Fonds Finanz. The first tariff partner is HDI. Other distributors and product providers will follow.

Contact

Stefanie Dadson | stefanie.dadson@xempus.com | Tel: 089 2000 17 59 | www.xempus.com