Goldman Sachs Asset Management new anchor investor with seat on Supervisory Board.

Munich, 10 March 2022 – Xempus AG, a leading European SaaS platform to sell and manage pension & life insurance policies, has raised $70m in primary equity funding on its mission to digitize pensions for insurers, agents, corporates, and employees. This brings the total funding to date to $125m.

The Series D financing round is led by Goldman Sachs Asset Management, a leading global growth equity investor in B2B SaaS businesses with particular strength in Insurtech.

Existing investors, led by HPE Growth and Cinco Capital, participated in the round in substantial size as well.

Xempus intends to use the proceeds to:

- Broaden its market leading policy sale and management offering in Germany;

- Add new product verticals to the platform, such as corporate health insurance;

- Roll out the Xempus platform in additional European countries.

In Germany, Xempus is the leader in its field with more than 100,000 new policies sold via its platform per year, connecting 18,000 insurance agents, 60,000 corporates and the leading life insurers. They benefit from seamless information flows, user-friendly customer journeys, as well as connectivity to all relevant stakeholders on a single software-as-a-service platform.

The Covid-19 pandemic has further accelerated the demand for digital insurance distribution solutions. Since March 2020, Xempus has:

- Signed more than 15 leading life insurers as new platform customers;

- Helped generate approx. €7bn in secured future revenue for insurers;

- Added more than 7,000 new insurance agents;

- Helped agents earn more than €200m in commissions;

- Continued its trend of 100%+ average annual subscription revenue growth over the last 4yrs;

- More than doubled its annual recurring revenue in 2021.

“We see a tremendous opportunity to further digitize the pension & life insurance market,” says Christian Resch, Managing Director in the Growth Equity business within Goldman Sachs Asset Management. “The global retirement funding gap is estimated to reach $400 trillion by 2050. Platforms such as Xempus will play a critical role in reducing this gap by increasing consumer understanding, choice and transparency.”

“We have been following Xempus for some time and are delighted to partner with Tobias, Malte and the entire Xempus team to lead the Series D. We have been impressed by the company’s strong growth momentum and look forward to helping Xempus expand its offering even further”, says Alexander Lippert, Executive Director in the Growth Equity business within Goldman Sachs Asset Management.

“The management team and shareholders are excited that Goldman Sachs is joining us on our journey”, adds Tobias Wann, CEO of Xempus. “This funding allows us to further accelerate our pace as we innovate and tech-enable the insurance market in Europe, delivering better value to insurers, agents, corporates and employees.”

“We have known the Goldman Sachs team for many years,” says Malte Dummel, Xempus CFO & COO. “Goldman Sachs and Xempus share the same unwavering focus on client service and long-term value creation. We are thrilled to partner with the team as we continue to build a leader in digital insurance distribution.”

Arma Partners acted as financial advisor to Xempus. Taylor Wessing acted as legal counsel to Xempus.

Download image material:

- Tobias Wann, CEO at Xempus

- Malte Dummel, COO & CFO at Xempus

- Decorative picture

About Xempus

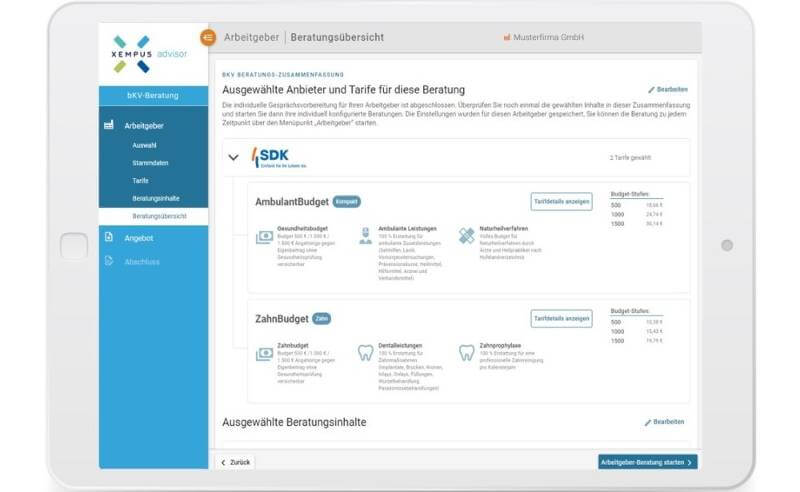

Xempus is the independent Software-as-a-Service (SaaS) platform and makes preventive care easy for everyone involved. For employees, pension provision becomes comprehensible. Employers simply inform and manage online. Agents provide fully digital advice right up to the conclusion of the deal. And insurers benefit through digital and customer-friendly processes. More than 170 employees work at Xempus in Munich (headquarters), Berlin and Saarbrücken.

About Goldman Sachs Asset Management Growth Equity

By bringing together traditional and alternative investments, Goldman Sachs Asset Management offers clients around the world a focused or comprehensive partnership – with a focus on long-term performance. We provide investment services to leading global institutions, financial advisors and individuals. Backed by our tightly integrated global network and insights from our investment professionals across geographies and diverse capital markets, we oversee more than USD 2 trillion in assets under supervision worldwide (as of December 31, 2021). We continuously deliver new insights – bundled in customized investment opportunities. A long-term partnership based on conviction: for joint success with sustainable results. Read more on LinkedIn. In the growth equity business within Goldman Sachs Asset Management, more than 75 experts focus on growth investments. Since 2003, more than $13 billion has been invested in companies led by innovative founders and CEOs. We focus exclusively on growth-stage investments and technology-driven companies in industries such as enterprise software, financial technology, consumer products and healthcare.

PR contact

Stefanie Dadson | stefanie.dadson@xempus.com | Tel: 089 2000 17 59 | www.xempus.com