Robust growth, higher valuation totals – agile and digital insurers and intermediaries benefit.

Munich, July 29, 2021 – Xempus, the independent platform for preventive care, has analyzed its own data during the period between January 2020 and June 2021, which was particularly affected by the Corona pandemic. And analyzed data from more than 100,000 consultations with regard to changes in applications, sales channels or types of tariffs in demand.

Xempus was able to gain seven key insights from the platform data evaluation:

1: Closures: Initial uncertainty quickly overcompensated for

The pandemic had an immediate impact on customer demand initially, with a sharp drop in applications of around 40 percent in the first lockdown in April 2020. But by August 2020, the number of applications for occupational pension plans had already risen to pre-crisis levels (here: January 2020), and after a further (slight) decline in the second lockdown at the end of the year, the number of applications rose sharply again from January 2021.

2: Higher valuation sums for contracts during pandemic period

It is interesting to note that the average assessment amount and gross wage of claimants increased by 10 to slightly over 15 percent during the period studied. This suggests that higher-income individuals in particular also took out an occupational pension during the lockdown, while lower-income employees tended to wait for the pandemic to unfold.

3: More agile insurers respond faster to change

Small and mid-sized insurers experienced a much smaller drop in applications than larger insurers during the initial lockdown and grew more strongly thereafter. “The various occupational pension providers on the Xempus platform seem to have handled the changes differently. Accordingly, the more agile and digital insurers on our platform were able to respond better to changing customer needs and gain significant market share,” analyzes Malte Dummel, COO and CFO at Xempus.

4: Multiple agencies can expand market share in distribution

On the sales side, multiple agencies in particular have been able to benefit compared with tied agents and brokers. According to Malte Dummel, this also speaks for a particularly fast reaction and adaptation capacity with regard to the challenges of the pandemic.

5: Safety first: classic products experience a boost

The pandemic has caused uncertainty among many people – and thus strengthened the quest for security, at least temporarily. Classical and new-classical tariffs have increased in proportion, even though the majority of contracts are still fund-based policies. Here, too, it can be seen that product providers who were able to meet customer needs quickly were able to expand their market share.

6: Intermediaries and customers have learned from the first lockdown

If we look at the developments in the two lockdowns in detail, we can see that there is a clear habituation effect among intermediaries and customers. The number of applications did not fall below pre-crisis levels in the second lockdown – as it did in the first lockdown. “Apparently, both sides have quickly learned to deal with the lockdown and now rely much more on digital solutions that are no longer dependent on on-site appointments,” explains Malte Dummel.

7: Conclusion: Digital offerings help bring intermediaries and customers together

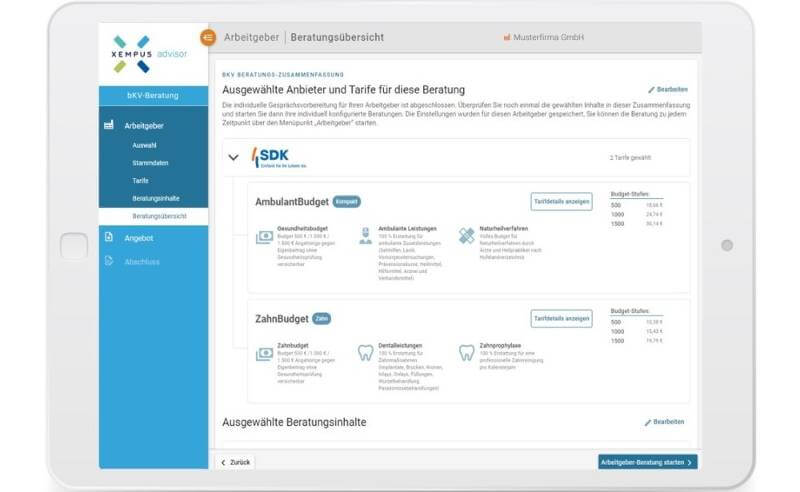

According to Malte Dummel, one important lesson learned from the crisis is that digital offerings help: “Digital tools and processes for consulting, closing and administration are useful for meeting customers’ rising expectations. Employers also benefit from more efficient processes with easy digital administration,” Dummel notes.

About the study

For the study, Xempus evaluated its own platform data – more than 100,000 consultations – and lockdowne effects from January 2020 to the end of June 2021. The number of occupational pension applications via the Xempus platform was examined over time per insurer, distinguishing between large and small insurers, as well as per sales channel (broker, multiple agency, exclusive) and per tariff/product type (classic, fund, index).

Contact

Stefanie Dadson | stefanie.dadson@xempus.com | Tel: 089 2000 17 59 | https://www.xempus.com/pub

Graphics: